Evolution of Cyber Insurance

Theoretical Summary: Cyber Insurance Sector

Cyber insurance has gained prominence and today forms a considerable part of every organization’s financial plan. However, this did not happen overnight, it was not until the early 2000s when organizations began to fend off some internet risks. The situation was further clarified as far as that more than one feasible proposal was brought forward which encompassed digital malfunction cases.

Thus, by the early years of the decade, the market recognized the need for insurance coverage initially as targeted incidents like Target’s breach, start emerging. Cyber insurance has continued to grow such that the organizations in different sectors can now find industry specific solutions.

Importance of Cyber Insurance in 2024

Risks and Understand System in the Field of IT

As we look forward to 2024, the digital world is burdened with even higher risks and threats this time around. Professional hackers and cybercriminals have turned their focus into businesses of every scale. Some of the common Thallium 2 particularly include:

-Ransomware Attacks: Malicious emerging technology can bungle the operations of a computer system and will demand unwieldy ransoms.

-Data Breaches: Any unauthorized access to the corporate data of a company can be as damaging as it is for the reputation.

Examples: Vanguard Clean Energy Density Enhances Phishing Scams: In simple words, unheard tasks are hypothesized and challenging imaginative persons’ faculties of having sound reasoning where they give stupid policies because they are stupid!

Knowing twenty-first century threats is key to business managing the contemporary technological environment.

Benefits of Cyber Insurance Coverage

Understandably, cyber insurance provision helps in addressing and eradicating the effects of such threats. There are various positive features of cyber security insurance. These help are:

-Financial Protection: The current protects clients by compensating them in losses connected to data breaches and other business delays.

-Legal Support: Helps with the legal costs as a result of legal claims and updating laws and regulations.

-Crisis Management: Utilization is then enabled to the Incident Management specialists, who shall hold the events effectively.

Businesses that are fighting risks by not only protecting their assets but also in anticipation of such risks in the form of cyber insurance cover.

Reasons Cyber Liability Insurance Has Gained Prevalence

Laws changing the Landscape of Cyber Insurance

Changes have shifted the focus of cyber insurance in the recent past following new legal frameworks. Such laws as the GDPR and the CCPA have come into being whereby organizations are forced to take care of the personal information and data that they have in their custody. The financial implications of loss or failure to comply with such legal requirements are known to be huge and companies have thus come to see the relevance of insurance.

Data Complementing Information Security Laws: Enactment of these laws imposes an obligation on organizations to store data safely.

Increase in Compliance Cost: Failure to adhere to these provisions can attract significant financial penalties.

Technology and Cyber Security Risks

On the other hand, the rapid pace of technological change also present cyber security risks of a different nature. Use of state-of-the-art technology systems such as IoT and cloud technology by businesses exposes them to even more weaknesses.

Some of these problems include:

-Dynamic Threats: On the one hand, cyber threats have become more of a concern for enterprises. Threats increase rapidly.

-Escalated Defense: Security systems advancement requires daily updates and at time it is most tiring.

For this kind of change, as businesses opt for these new innovations, the need for cyber insurance that is all inclusive is unmistakable so that any probable risks are controlled.

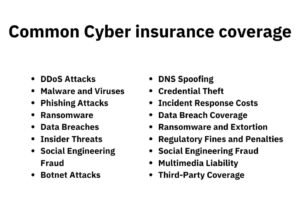

Types of Cyber Insurance Coverage

Including but not limited to, Data Breach Insurance

Data Breach Insurance policy it is a policy is sold to organization to help them cushion their finances that they might incur if a data breach is to happen to them. Almost all organization in the Data-reliant world issue such type of policy. In case of breach within an organization, a certain number of costs must be accounted for and met by the organization, which includes the following:

-Notification Costs: Provision for informing individuals or businesses affected as required by the law.

-Credit Monitoring: It involves giving out the credit monitoring services that prevent the targeted consumers from being easier for identity theft.

Legal Fees: Legal advice and regulatory fines and other costs are also covered.

For example, a company I am conversant with had a data breach, and the data breach cover the Company had in place helped the company successfully navigate through the disaster without great financial loss.

Introduce with threshold definition of Cyber Liability Insurance

This coverage has a broader scale of coverage – cyber liability insurance – reaches at cyber risk, for organizations. These risks include:

Third Party Claims: Clients or vendors may sue an organization, and cyber liability insurance covers these liabilities.

More specifically business omission: Associated cover for cyber perils.

Using this kind of insurance makes sure that even in a catastrophe you can rely on some fund. A better approach can be designing insurance policies that are more effective by coming to terms with the insurance coverage options.

How to Identify the Right Cyber Insurance Policy

Identifying the Risks and Vulnerabilities of the Company

Selecting a cyber insurance coverage, first, requires the identification of the business risks and vulnerabilities. Every organization faces certain difficulties which can be measured through a risk assessment. For instance:

-Conduct: Security Audits so that the weak points in the current cyber security state are exposed.

-Staff: Employee Training on how to interact with possible threats, such as phishing.

For instance, a data management weakness of a person’s e-commerce company was strengthened in such a way that profitable insurance policies were taken against certain risks.

Concept of Understanding Ranging from Policy Coverage to Exclusions

The next thing that one needs to focus on is fully understanding what policy covers and what policy excludes. Pay attention to the following:

Policy limits: Watch out for how much the policy will pay out in case of a claim.

Exclusions: Find out the situations that the policy does not address and which can serve as a huge surprise in the future.

This depth of information is provided to businesses so that they can find the exact skin masks and services within their operational context, especially during the time of need.

Future Outlook of Cyber Insurance

Emerging Trends in Cyber Insurance

While many things may change in the future, when it comes to to the world of cyber insurance, there are several emerging trends that will make the market grow. Most of them are nothing but the obviously incessant changing of the numerous rules and regulations of cyber insurance with one major phenomenon drawing everybody’s attention.

Predictions for the Cyber Insurance Market

Going forward, the specialists promise future increase of the cyber insurance market. Some of the major predictions are:

1. Market Expansion: With more and more businesses coming to terms with the necessity of applying for cyber insurance, the volume of the market is anticipated to increase twofold in the next few years.

2. Regulatory Impact: It is more likely that more controls will come into place and this will lead to the rise in demand for policies that address specific requirements related to cybersecurity.

These trends show that issues in the cyber insurance sphere will follow the digitalization trend and will offer more effective protection solutions for new threats of cyber security.